Unknown Facts About Clark Wealth Partners

Table of ContentsThe Buzz on Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is DiscussingA Biased View of Clark Wealth PartnersThe Definitive Guide for Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedA Biased View of Clark Wealth PartnersThe Facts About Clark Wealth Partners Uncovered

The globe of money is a difficult one., for instance, lately located that almost two-thirds of Americans were incapable to pass a standard, five-question monetary proficiency test that quizzed individuals on subjects such as interest, financial debt, and various other relatively fundamental principles.In enhancement to managing their existing clients, economic experts will certainly often invest a fair quantity of time every week meeting with possible customers and marketing their services to keep and grow their service. For those thinking about becoming a financial consultant, it is very important to think about the ordinary income and task security for those functioning in the field.

Courses in taxes, estate planning, investments, and risk management can be useful for pupils on this course. Relying on your special occupation goals, you may additionally require to gain certain licenses to satisfy certain customers' demands, such as dealing stocks, bonds, and insurance plan. It can likewise be practical to earn an accreditation such as a Licensed Economic Organizer (CFP), Chartered Financial Analyst (CFA), or Personal Financial Professional (PFS).

The smart Trick of Clark Wealth Partners That Nobody is Discussing

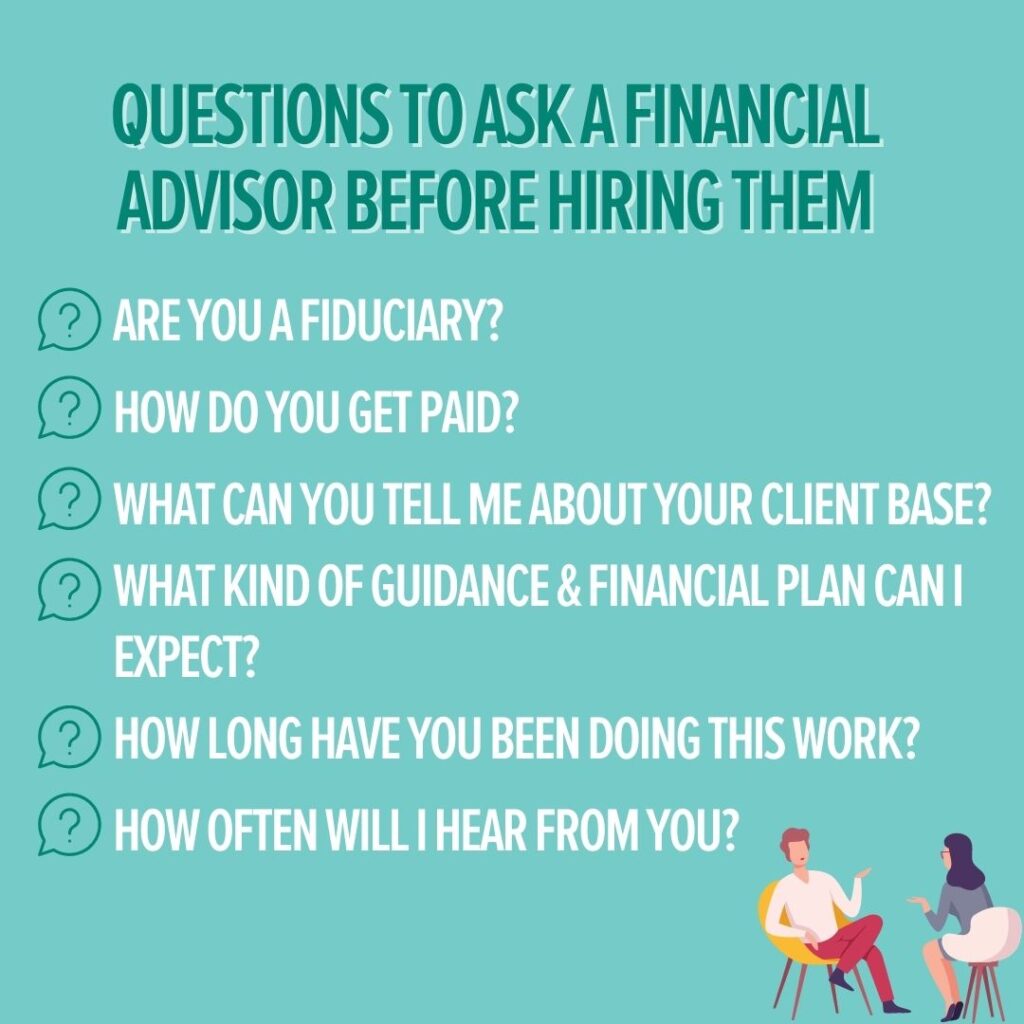

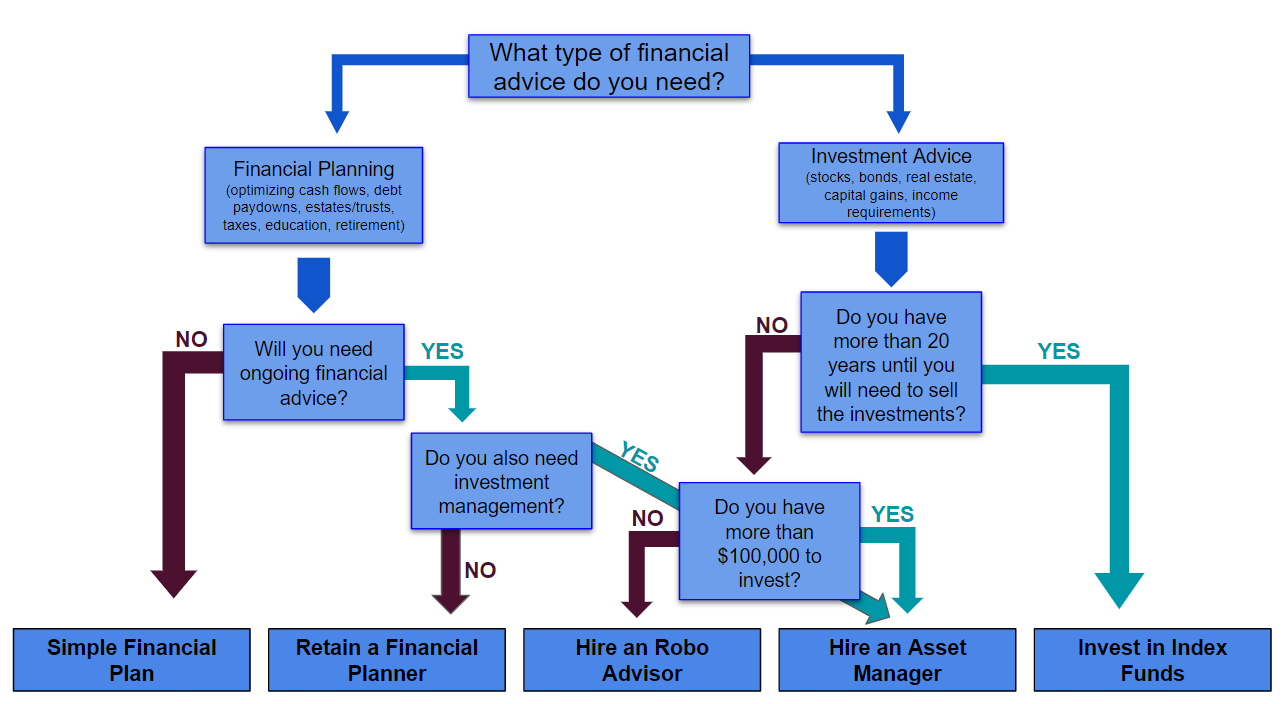

Lots of people decide to obtain assistance by making use of the solutions of an economic professional. What that looks like can be a variety of things, and can vary depending on your age and phase of life. Prior to you do anything, study is essential. Some people stress that they require a specific amount of money to invest before they can get help from an expert.

Clark Wealth Partners Things To Know Before You Get This

If you haven't had any experience with an economic expert, right here's what to anticipate: They'll begin by offering a thorough evaluation of where you stand with your properties, liabilities and whether you're fulfilling criteria compared to your peers for cost savings and retirement. They'll evaluate short- and lasting objectives. What's handy regarding this step is that it is customized for you.

You're young and working full time, have a vehicle or 2 and there are trainee fundings to pay off.

Not known Facts About Clark Wealth Partners

You can discuss the following ideal time for follow-up. Financial consultants usually have different tiers of rates.

You're looking in advance to your retired life and helping your kids with higher education prices. A monetary expert can use recommendations for those situations and more.

Clark Wealth Partners Can Be Fun For Anyone

That might not be the finest method to keep building riches, specifically as you progress in your profession. Schedule normal check-ins with your planner to modify your strategy as needed. Stabilizing financial savings for retired life and university expenses for your kids can be tricky. A financial consultant can aid you prioritize.

Believing around when you can retire and what post-retirement years could appear like can create problems concerning whether your retired life financial savings are in line with try these out your post-work plans, or if you have saved enough to leave a tradition. Assist your monetary specialist understand your strategy to money. If you are extra conventional with saving (and prospective loss), their recommendations should react to your worries and problems.

10 Easy Facts About Clark Wealth Partners Described

As an example, planning for healthcare is just one of the large unknowns in retired life, and a financial professional can lay out choices and recommend whether additional insurance as protection might be practical. Before you start, attempt to obtain comfortable with the idea of sharing your entire monetary picture with an expert.

Offering your professional a full image can help them produce a strategy that's prioritized to all parts of your monetary condition, particularly as you're quick approaching your post-work years. If your finances are basic and you have a love for doing it on your own, you might be great on your own.

An economic consultant is not just for the super-rich; any person dealing with significant life transitions, nearing retirement, or sensation overwhelmed by financial decisions could take advantage of specialist advice. This article checks out the duty of financial experts, when you may require to consult one, and crucial factors to consider for selecting - https://pxhere.com/en/photographer-me/4831754. An economic advisor is an experienced expert who assists customers manage their financial resources and make informed choices that align with their life goals

What Does Clark Wealth Partners Mean?

In comparison, commission-based experts make revenue with the monetary products they sell, which may affect their referrals. Whether it is marital relationship, separation, the birth of a child, job adjustments, or the loss of an enjoyed one, these events have distinct economic effects, commonly requiring timely decisions that can have lasting results.